crypto tax accountant canada

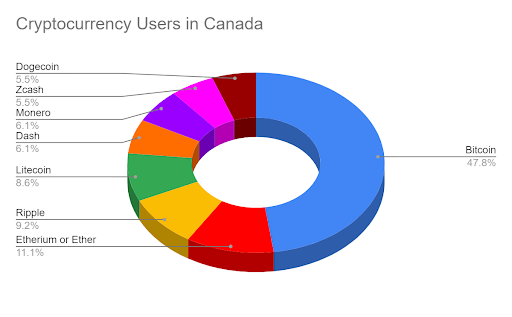

Will apperiacte greatly if someone can. Cryptocurrency is taxed like any other investment you make in Canada.

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada.

. We are one of the first blockchain accountants in Canada and have been working with a lot of different companies from the co-founder of Ethereum to bitcoin mining companies investors developers crypto exchanges Read More. The CRA announced theyre working with crypto exchanges to share customer information. Our professional accountants are well versed in calculating Crypto currency transactions and determining its tax implications.

Step 2 Calculate the Gains and Losses as per Canada Revenue Agency standards. 14 votes 17 comments. It helps you calculate capital gains and income year after year.

Our directory has tax accountants from the US Canada Europe Australasia and other parts of the world. In the summer of 2018 an international coalition of taxadministratorsincluding the Canada Revenue Agency CRA andthe United States Internal Revenue Service IRSpromised topool their resources and expose cryptocurrency users who dodgedtheir tax obligations. Unit 210 12877 76 Avenue Surrey BC V3W 1E6 Canada.

The UI is one of the best in the crypto tax field and in addition to handling tax reporting for the US Australia and Canada it also supports tax reporting for more than 20 other countries. The Canada Revenue Agency can track your crypto investments. Combining our deep industry insights and cross functional experience our team of IT supply chain and operations risk compliance tax audit and emerging technology professionals are ready to help you achieve your vision.

Success Accounting Services specializes in preparing cryptocurrency tax returns we review and inspect the Crypto Proceeds of Disposition Adjusted Cost Base ACB and Crypto Exchange Fees to ensuring its complete and accurate before E-Filing the tax returns. Pay the invoice using your Bitcoin Lightning Network or Liquid Network wallet. ZenLedgers platform helps crypto investors and tax professionals with crypto tax filings and financial analysis by providing a digital workflow to simplify optimize and automate.

Do you handle non-exchange activity. 51 Kaiser Dr L4L 3V2 Canada MetaCounts MetaCounts is Canadas premier crypto specializing accounting firm and have helped numerous crypto investors figure out what needs to go on their tax return. There are two ways of calculating Crypto Taxes Business Income and Capital gain.

Bull Bitcoin will generate a Bitcoin invoice for the amount you want to send. How is crypto tax calculated in Canada. A Quick Guide to Accounting For Cryptocurrency.

Deixis is a Canadian accounting firm specializing in crypto tax and accounting services for Canadian investors. The tax return for 2021 needs to be filed by the 30th of April 2022. Press J to jump to the feed.

Perhaps this is your first tax year with crypto asset gains in which case we will also help you with high quality reports from the start. We are able to provide hands-on accounting and tax services to a wide range of businesses regardless of whether they are private or public corporations or nonprofit. KPMG in Canada provides end-to-end cryptoasset and enterprise blockchain services from strategy to implementation.

Similarly your crypto taxes for the 2022 financial year must be filed by the 30th of April 2023. Theyre using this information to track Canadian crypto investors to ensure theyre reporting their crypto investments accurately and paying their fair share of crypto tax. For those wondering the Candian Revenue Agency has made it clear that yes Bitcoins and Cryptocurrencies need to be disclosed on taxes this year.

We handle all non-exchange activity such as onchain transactions like Airdrops Staking Mining ICOs and other DeFi activity. Press question mark to learn the rest of the keyboard shortcuts. TaxBit is a cryptocurrency tax software for Canada based on the Canadian tax law.

The cryptocurrency tax software called TaxBit is a crypto tax software that claims to help people with their tax filing for digital currencies. Well untangle it for you. Our clients can focus on their core business and leave crypto accounting services of crypto tax accountant Canada.

Get started today and maximize your refund. Our directory of CPAs tax preparers and tax attorneys helps crypto traders help find a knowledgeable tax accountant for crypto tax advice planning and tax returns. Whether you require cryptocurrency investment transaction reconciliations tax compliance tax return preparation and tax planning services.

Best crypto tax accountant in canada SDG Accountant. To create an e-Transfer order simply select a recipient and add the dollar amount you want the recipient to receive. You need to report both your income and capital gains from cryptocurrencies in your tax return to the CRA.

50 of any gains are taxable and. Bull Bitcoin will send the Interac e-Transfer to the recipient. No matter what activity you have done in crypto we have you covered.

Step 1 Determine if trading of Crypto Currency is considered Capital Gains or Business income. Book a call today to discuss your. Hi all i am looking for a tax adviser with a good knowledge of crypto tax filing.

Giacomo Meggetto is a Chartered Professional Accountant with over 35 years of tax experience. Bomcas Canadas professional tax accountants have a wealth of knowledge and hands-on experience in the realms of cryptocurrencies and blockchain technology which they bring to their clients. Unit 210 12877 76.

Take the burden off your shoulders. We also have a complete accountant suite aimed at accountants. We have a deep technical understanding of software and tax which enables us to optimise your.

We offer an extensive range of crypto taxation and accounting services tailored to the specific needs of our clients. If this is you then its time to get help. Since then the CRA the IRS and other tax administrators haveonly fine-tuned the.

Cryptocurrencies Income Tax Implications In Canada Maroof Hs Cpa Professional Corporation Toronto

What You Should Know About Cryptocurrency Tax In Canada Moneysense

Crypto Currencies Reporting And Taxation Maroof Hs Cpa Professional Corporation Toronto

Koinly Review Is It Good For Canadians April 2022 Updated

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Bitcoin Cryptocurrency Ecommerce Accountants Bookkeepers

Canada Crypto Tax Sdg Accountant

Cra Audits Cryptocurrency Revised Canadian Tax Amnesty

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Additional Business Services Tax Consultant Toronto

Crypto Tax Accountant Canada Filing Taxes

Additional Business Services Tax Consultant Toronto

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

How To Cash Out Crypto Without Paying Taxes In Canada May 2022 Yore Oyster

Best Crypto Tax Accountant In Canada Sdg Accountant

8 Ways To Avoid Crypto Taxes In Canada 2022 Koinly