bexar county tax office property search

The records to which access is not otherwise restricted by law or by court order are made available through our Public Records Search. Ad Enter Any Address Locate Previous Property Owner Records for Your State.

Get Property Records from 2 Treasurer Tax Collector Offices in Bexar County TX Bexar County Tax Collector 233 N Pecos La Trinidad San Antonio TX 78283 210-335-2251 Directions Bexar County Tax Collector 640 Southwest Military Drive San Antonio.

. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. Search for records and reports of. For website information contact 210 242-2500.

2022 and prior year appraisal data current as of Aug 5 2022 724AM. For website information contact 210 242-2500. Welcome to the Bexar Appraisal District is responsible for appraising all real and personal.

Access the Bexar County Website. Collector does not set tax rates or set property values. Bexar Property Tax Invoice Search Results.

Southside - 3505 Pleasanton Rd. Resources and searches to help you find the information you need. 2022 and prior year appraisal data current as of Aug 5 2022 724AM.

Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to. The Bexar County Clerks Office Recordings Division files records and maintains Real Property Records Personal Property Records Notice of Trustee Sales Military Discharges and Public Notices. Bexar County Property Tax Account Search.

Bexar County Property Tax Invoice Query. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Reports Record Searches.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. Northwest - 8407 Bandera Rd. Downtown - 233 N.

1 How to Search View Download Print and Pay the Bexar Property Tax Receipt. For information on obtaining a Marriage License please contact the Bexar County Clerks Office at 210 335-2221 or visit the. Go to Type of Search and select the Search Criteria of Owner Name last name first name.

Ad Receive Bexar County Property Records by Just Entering an Address. BCSO Jail Activity Report. Property Tax Payment Options.

The united states tx tax assessor property tax code requiring taxing units tax search tabs above. Search For Bexar County Online Property Taxes Info From 2022. For property information contact 210 242-2432 or 210 224-8511 or email.

Enter an account number owners name last name first address CAD reference number then select a Search By option. Please follow the instructions below. The amount you paid for your used vehicle.

Protest status and date information current as of Aug 13 2022 113AM. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. Pecos La Trinidad.

Protest status and date information current as of Aug 15 2022 113AM. Property Tax Overpayments Search. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County.

The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state. Reports Record Searches. For website information contact 210 242-2500.

For property information contact 210 242-2432 or 210 224-8511 or email. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. Jurors parking at the garage will receive a discounted rate please bring your parking ticket for validation at Jury Services.

Owner Name Last name first. Property Tax Account Search. 211 South Flores Street San Antonio TX 78207 Phone.

Rates will vary and will be posted upon arrival. Protest status and date information current as of Aug 15 2022 113AM. Search for any account whose property taxes are collected by the Bexar County Tax Office for overpayments.

Bexar County Payment Locations. Northeast - 3370 Nacogdoches Rd. Locate Bexar Property Tax Options.

2022 and prior year appraisal data current as of Aug 5 2022 724AM. For property information contact 210 242-2432 or 210 224-8511 or email.

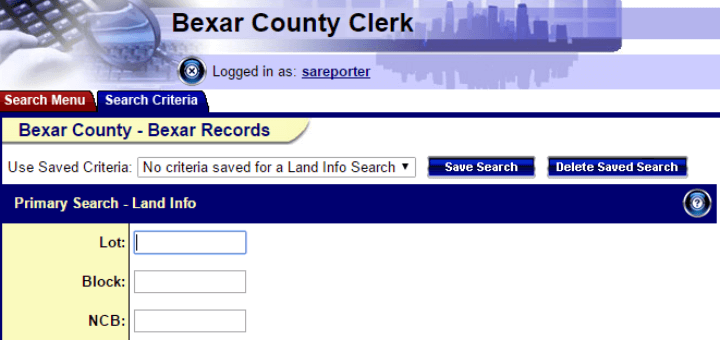

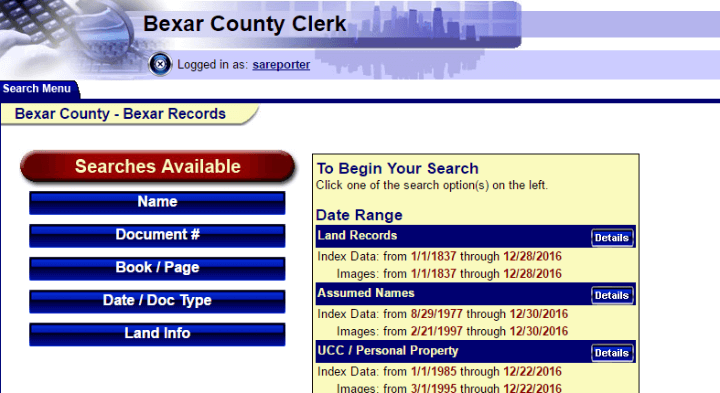

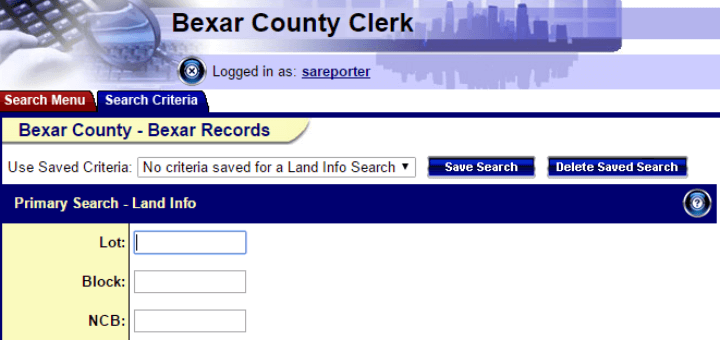

Real Property Land Records Bexar County Tx Official Website

Public Record Searches Bexar County Tx Official Website

Bexar County Texas Property Search And Interactive Gis Map

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Bexar County Once Again Selling Homes Delinquent On Their Taxes

Information Lookup Bexar County Tx Official Website

Property Tax Information Bexar County Tx Official Website

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

Bexar County Building Use Bexar County Tx Official Website

Homestead Exemptions Here S What You Qualify For In Bexar County

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Real Property Land Records Bexar County Tx Official Website

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Public Service Announcement Residential Homestead Exemption

Everything You Need To Know About Bexar County Property Tax

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/FIN4Q7VOD5GDFMHBKTNEEM7YCY.jpg)